New Tax Law for Individuals in Nigeria (2026): Complete Guide to Nigeria Tax Act 2025

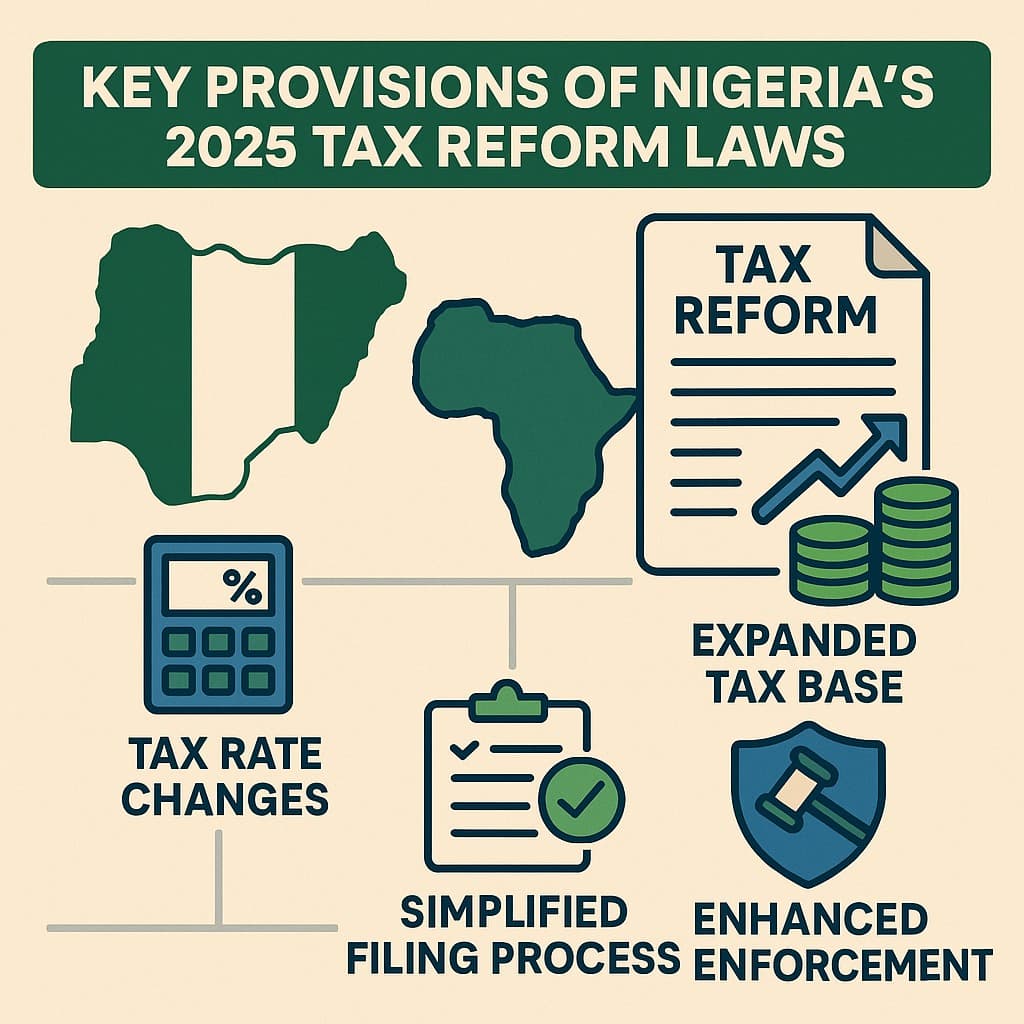

Nigeria has introduced a major overhaul of its tax system with the enactment of the Nigeria Tax Act, 2025, effective January 1, 2026. The new law simplifies tax compliance, consolidates tax legislation, and introduces significant changes affecting individual income tax, rent relief, capital gains tax, and filing obligations.

This guide explains everything individuals need to know about the new tax law in Nigeria and how it affects personal finances.

The Nigeria Tax Act 2025 consolidates multiple tax laws into a single framework. This reform removes duplication, improves clarity, and strengthens coordination between tax authorities.

Key benefits:

- Simplified personal income tax rules

- Clearer tax compliance obligations

- Reduced conflicts between tax regulations

- Improved taxpayer certainty

This consolidation is one of the most significant tax reforms in Nigeria in recent decades.

Who Pays Tax Under the New Nigeria Tax Law?

Under the new tax law, an individual is tax resident in Nigeria if:

- They spend 183 days or more in Nigeria within a 12-month period, or

- They maintain strong economic, family, or business ties to Nigeria

Important:

Once classified as a resident, global income is taxable in Nigeria, not just income earned locally.

This aligns Nigeria with international global income taxation standards.

Personal Income Tax Rates in Nigeria (2026)

The new law introduces a tax-free income threshold and a progressive tax structure.

Nigeria Personal Income Tax Structure:

- ₦800,000 annual income – tax free

- Progressive tax rates apply above ₦800,000

- Maximum tax rate: 25%

This structure protects low-income earners while ensuring fairness across income levels.

Rent Relief Under the New Nigeria Tax Law

To reduce housing pressure, the Nigeria Tax Act introduces rent relief for individuals:

- Up to ₦500,000, or

- 20% of annual rent paid (whichever is lower)

This relief reduces taxable income and directly lowers personal income tax liability.

Annual Tax Return Filing Requirement in Nigeria

The new law makes annual tax return filing mandatory for individuals:

- Applies even where no tax is payable

- Covers salaried, self-employed, and mixed-income earners

- Late or non-filing attracts penalties

Proper documentation and compliance are now more critical than ever.

Capital Gains Tax in Nigeria (2026 Update)

Capital gains are now fully integrated into the personal tax framework:

- Capital Gains Tax rate: up to 25%

- Applies to sale of assets such as property, shares, and investments

- Strengthens taxation of investment income

This change closes gaps and improves fairness in asset-related taxation.

Key Highlights of the New Nigeria Tax Law

- ₦800,000 tax-free income threshold

- Progressive income tax rates up to 25%

- Rent relief up to ₦500,000 or 20% of rent

- Global income taxed for Nigerian residents

- Mandatory annual tax return filing

- Capital gains taxed at up to 25%

Why the Nigeria Tax Act 2025 Matters

The new tax law for individuals in Nigeria promotes:

- Fair taxation

- Increased transparency

- Better protection for low-income earners

- Stronger tax compliance culture

Understanding these rules early helps individuals plan better, reduce risk, and stay compliant.

Need Help With Tax Compliance in Nigeria?

If you need assistance with:

- Personal income tax planning

- Tax residency determination

- Rent relief and capital gains tax computation

- Annual tax return filing

Outliers provides expert tax advisory and compliance services.

📧 info@outlierspro.com

🌐 www.outlierspro.com

📞 0805 197 6005